When it comes to making your dreams a reality—be that the new car, your dream house, or funding education—the first step is figuring out how much loan you’re eligible for. At Global IME Bank, we simplify and explain the eligibility calculator that determines your eligibility; with the calculator, you can easily find EMI and the loan amount for a loan with us.

This digital facility is aimed at helping you ascertain your loan eligibility in seconds, without any documentation or branch visit or wait time. In this detailed guide, we will explain about using Global IME Bank’s Eligibility Calculator and how it works and help you in better planning your finances.

What is the Eligibility Calculator?

Eligibility Calculator by Global IME Bank is our online eligibility calculator, a simple and convenient tool to know your maximum loan eligibility on the basis of your monthly income and expenses.

Whether you’re looking to obtain a housing loan, car loan, or education loan, this calculator will ensure that you earn an ideal rate, and it helps you decide sooner rather than later what kind of terms need to be offered.

Types of Loans You Can Check With the Eligibility Calculator

At Global IME Bank, the eligibility calculator supports multiple loan categories, making it a one-stop platform for all your financial planning needs.

1. Home Loan Eligibility

If you’re planning to buy or build your dream home, this feature helps you estimate how much housing loan you can qualify for based on your monthly income, expenses, and interest rate. Institutions like Global IME Bank now offer home loans covering up to 70% of property value, making mortgages a mainstream path to home ownership.

2. Auto Loan Eligibility

Dreaming of buying a new car? Use the calculator to know the loan amount you’re eligible for and the monthly EMI you’ll pay. The Nepal Automobile Dealers’ Association reports that nearly 90% of car buyers take auto loans. This helps you choose the right car and budget accordingly.

3. Education Loan Eligibility

Planning for higher education in Nepal or abroad? Estimate your education loan eligibility to manage tuition fees, living expenses, and more—all through a simple online calculation.

How to Use the Global IME Bank Eligibility Calculator (Step-by-Step Guide)

Using the Global IME Bank eligibility calculator makes the process quick and simple and requires only a few basic details. Follow these easy steps:

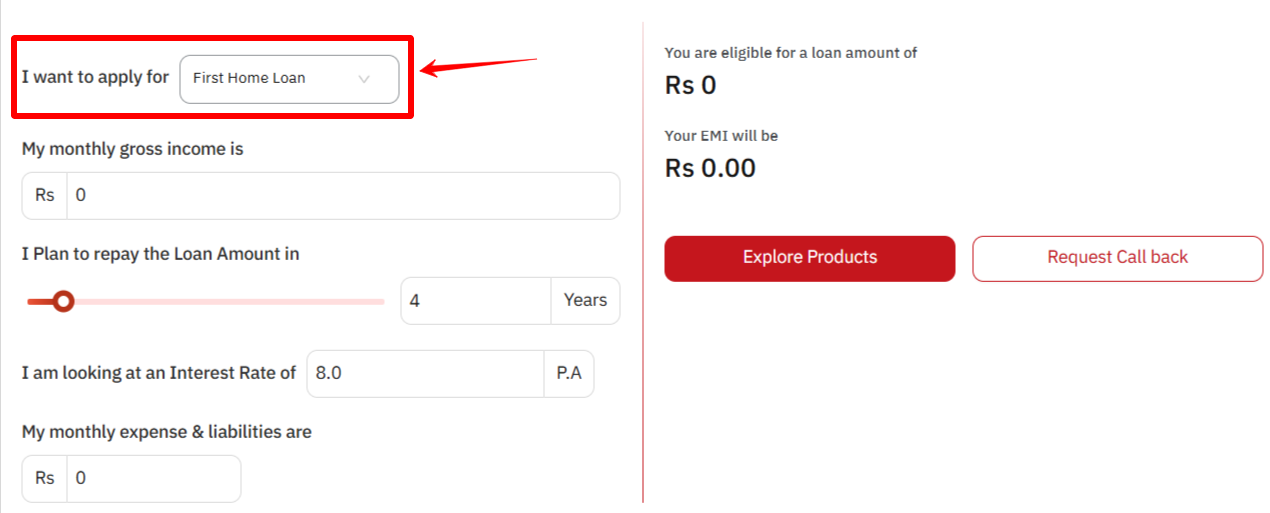

Step 1: Select the Type of Loan

You can start by choosing the loan type you’re interested in:

- Auto Loan

- First Home Loan

- Home Loan

- Education Loan

You can select the preferred option from the drop-down menu labeled “I want to apply for.”

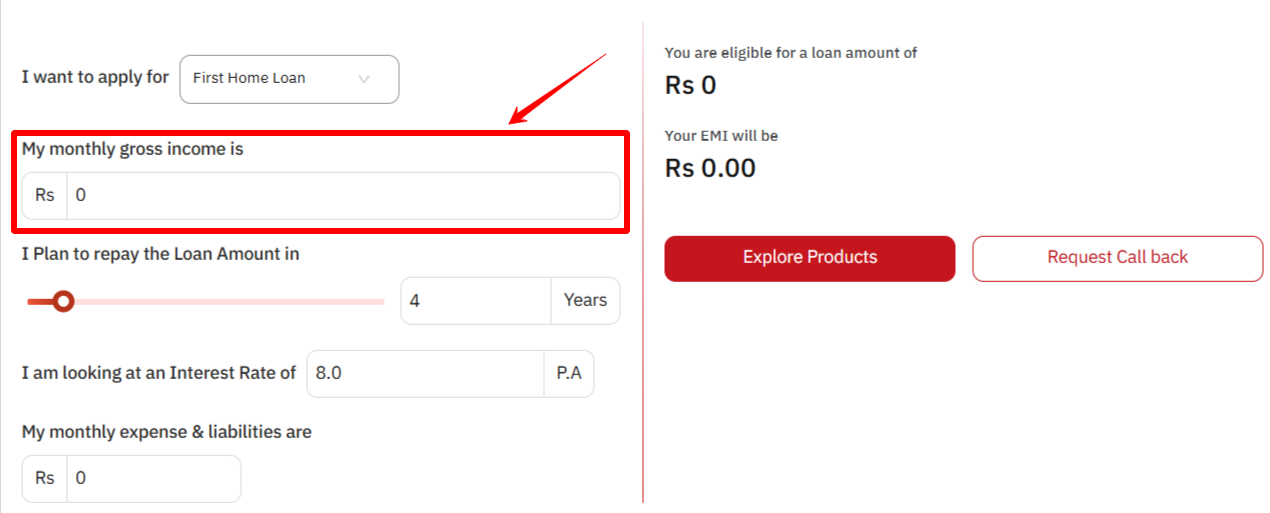

Step 2: Enter Your Monthly Gross Income

In the field labeled “My monthly gross income is,” enter your total monthly earnings before any deductions.

This includes salary, business income, rent, or any other regular income source.

Example: Rs. 100,000

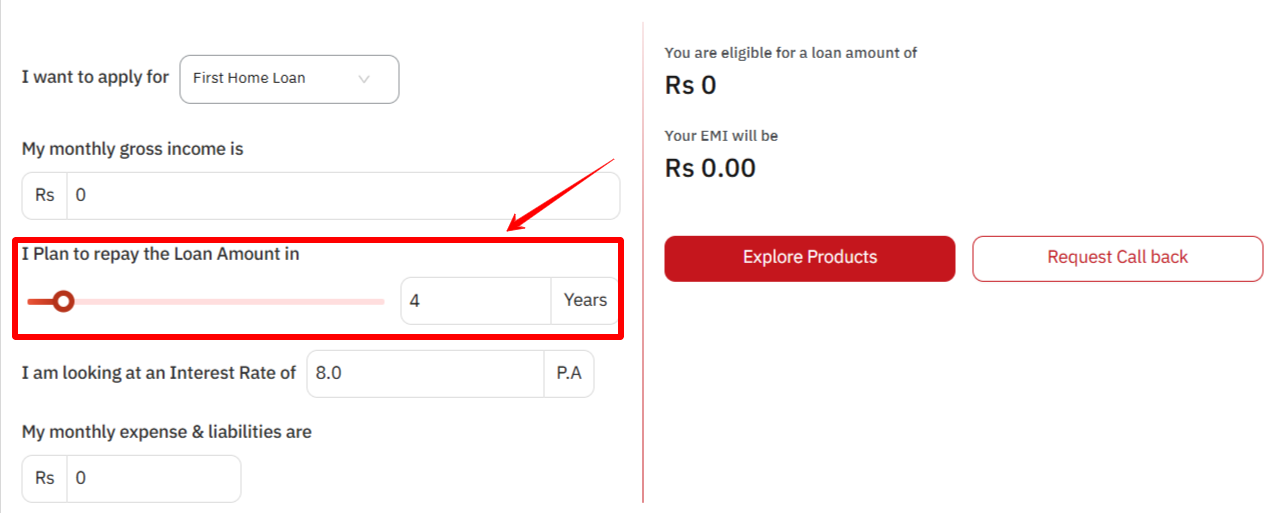

Step 3: Choose Your Repayment Period

Next, decide how long you want to repay the loan.

Use the slider or input field under “I plan to repay the Loan Amount in” to select the repayment period (in years).

Example: 4 Years

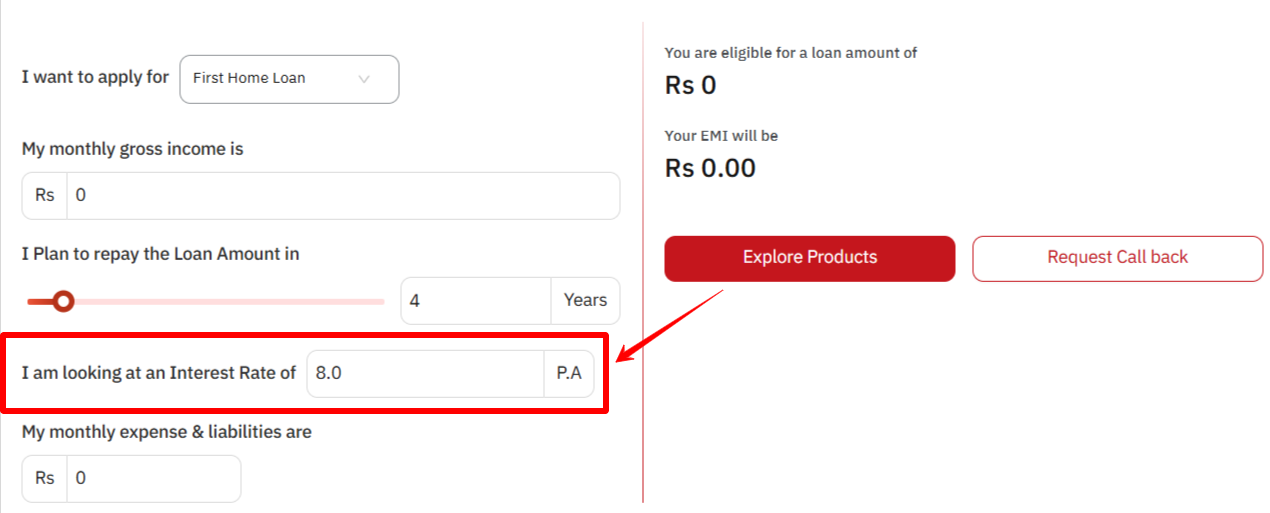

Step 4: Input the Interest Rate

In the section “I am looking at an interest rate of,” enter the interest rate applicable for the chosen loan.

Example: 8.0% per annum

If you’re not sure of the rate, you can check Global IME Bank’s website for latest interest rates.

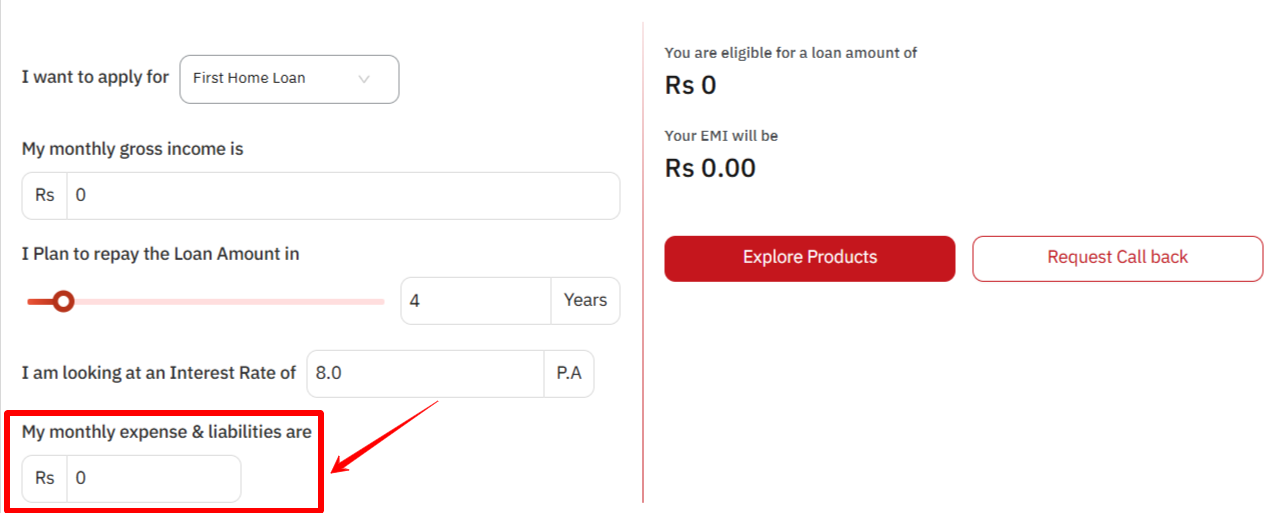

Step 5: Enter Monthly Expenses & Liabilities

Under “My monthly expenses & liabilities are,” add your existing monthly commitments—such as rent, other EMIs, or credit card payments.

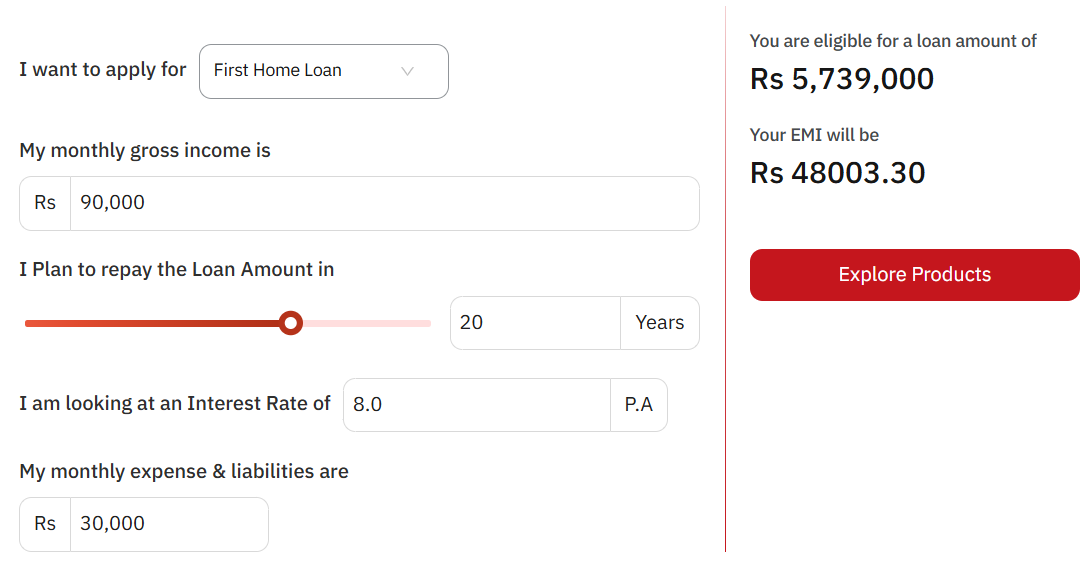

Step 6: View Your Eligibility Result

Once you’ve filled all the fields, the calculator instantly displays:

- Eligible Loan Amount

- Estimated EMI

Beyond the calculator, you’ll see options to Explore Products or Request a Call Back for personalized assistance.

How the Eligibility Calculator Helps You Plan Better

Using this calculator offers more than just numbers. It provides clarity, confidence, and control over your financial choices.

1. Instant Financial Insights

No need to wait for a bank representative. The tool gives real-time eligibility results—helping you plan faster.

2. Transparent and Reliable

It uses a standard formula based on income-to-debt ratio, interest rate, and loan tenure, ensuring accuracy and fairness.

3. Compare and Customize

You can adjust income, expenses, or tenure values multiple times to see how your loan eligibility and EMI change—empowering you to choose what fits your budget.

4. Saves Time and Effort

You can calculate eligibility online from anywhere—saving hours of branch visits and paperwork.

5. Supports Smart Decision-Making

Before applying, you already know what you can afford—reducing the risk of rejection and helping you manage future repayments comfortably.

Understanding EMI—What Does It Mean for You?

Your EMI (Equated Monthly Installment) is the fixed amount you pay each month to repay your loan.

It includes both principal and interest components, ensuring the loan is fully repaid by the end of the tenure.

The Eligibility Calculator automatically computes your EMI based on:

- Loan Amount

- Interest Rate

- Tenure

Example:

If your monthly income is Rs. 100,000 at 8% interest for 4 years, your EMI could be around Rs. 49,997.66 for a loan amount of Rs. 2,048,000.

This helps you balance your monthly expenses and ensure financial comfort.

Why Choose Global IME Bank’s Eligibility Calculator

Global IME Bank stands as one of Nepal’s most trusted financial institutions, offering digital solutions to make banking easier and faster.

Here’s why customers love using the Eligibility Calculator:

Easy to Use: No technical knowledge needed—just enter details and get instant results.

Accurate Estimates: Reflects realistic eligibility based on income and liabilities.

Free & Accessible: Available 24/7 on the bank’s official website.

Multiple Loan Options: Home, Auto, and Education—all in one platform.

Instant Next Steps: Explore products or request a callback from the bank’s experts.

How to Access the Global IME Eligibility Calculator

You can access the calculator anytime by visiting the

Global IME Bank Eligibility Calculator

Or simply search “Global IME Bank Loan Eligibility Calculator” on Google.

Once on the page, you can begin your calculation in less than a minute and find out your loan potential instantly.

The Global IME Bank Eligibility Calculator is more than just a digital tool—it’s your first step toward making smart financial choices.

Whether you’re buying a car, building a house, or planning your education, this tool helps you estimate your loan amount, plan your EMI, and take the next confident step toward your dream.

So, why wait?

Try the Eligibility Calculator today and find out how much you can borrow—quickly, securely, and accurately.

Frequently Asked Questions

What is the Global IME Bank Eligibility Calculator?

It’s an online tool that helps you check how much loan you qualify for based on your income, expenses, and loan term.

How can I use the Global IME Bank Eligibility Calculator?

Enter your monthly income, expenses, interest rate, and repayment period to instantly see your eligible loan amount and EMI.

What types of loans can I check with this calculator?

You can calculate eligibility for home loans, auto loans, and education loans.

Is the loan eligibility result accurate?

Yes, it gives a close estimate based on your financial details. Final approval depends on the bank’s verification process.