Teaching financial habits to children is one of the most meaningful lessons a parent can give. It is not about making them experts in money. It is about helping them understand how money works and how their choices affect it. The habits children form early often stay with them for life.

Why Teaching Financial Habits to Children Is Important

Teaching financial habits to children isn’t just about managing money; it’s about setting them up for future success. Early exposure to financial education helps children develop a responsible attitude towards money. Kids who understand the value of saving, budgeting, and smart spending are more likely to grow into financially responsible adults who are better prepared for the challenges of adulthood, including managing debt, investing, and saving for their future.

How to Teach Financial Habits to Children

Educating children about money habits involves teaching them how to earn, save, spend, and make money in a smart way.

Start with basics

Introducing the basic concept of finance is the first step of financial education. Introduce the concept of money from basic notes and coins. Explain how money is used as a medium of exchange for goods and services. Teach the value of money and how it is earned and spent. Children learn from parents. So talk openly about household expenses like groceries, electricity bills, or school fees. Involve them in family budgeting to demonstrate real decisions.

Encourage for Saving

One of the essential financial habits to teach children is saving. Learning to save teaches patience and planning. Setting aside even small amounts regularly builds confidence and shows how money grows over time. Start with a piggy bank for kids and a real savings account for adults.

Explain Needs vs. Wants

This is the most important skill for making good choices in life. Helping children differentiate between essential needs and fun wants teaches stronger financial decision-making. It stops impulse buying and helps them live within their means.

Understanding the Value of Money

A child needs to know that money comes from work. It is not just something that appears from a wallet. Teaching kids how money is earned and spent is essential for them to appreciate its value. Instead of giving money without context, show them the effort involved in earning it.

Budgeting and Goal Setting

A budget is just a simple plan for money. A goal is something you are saving that money for. It gives children a sense of control and purpose. Whether it’s saving up for a new toy, a bicycle, or a trip to a park, having a clear goal helps kids stay motivated and focused.

Encourage for Investing

Teach children about investment. Encourage them to invest and introduce them to different investment platforms. This helps to develop confidence, critical thinking, and risk management skills from an early age.

Best Apps for Teaching Financial Habits to Kids in Nepal

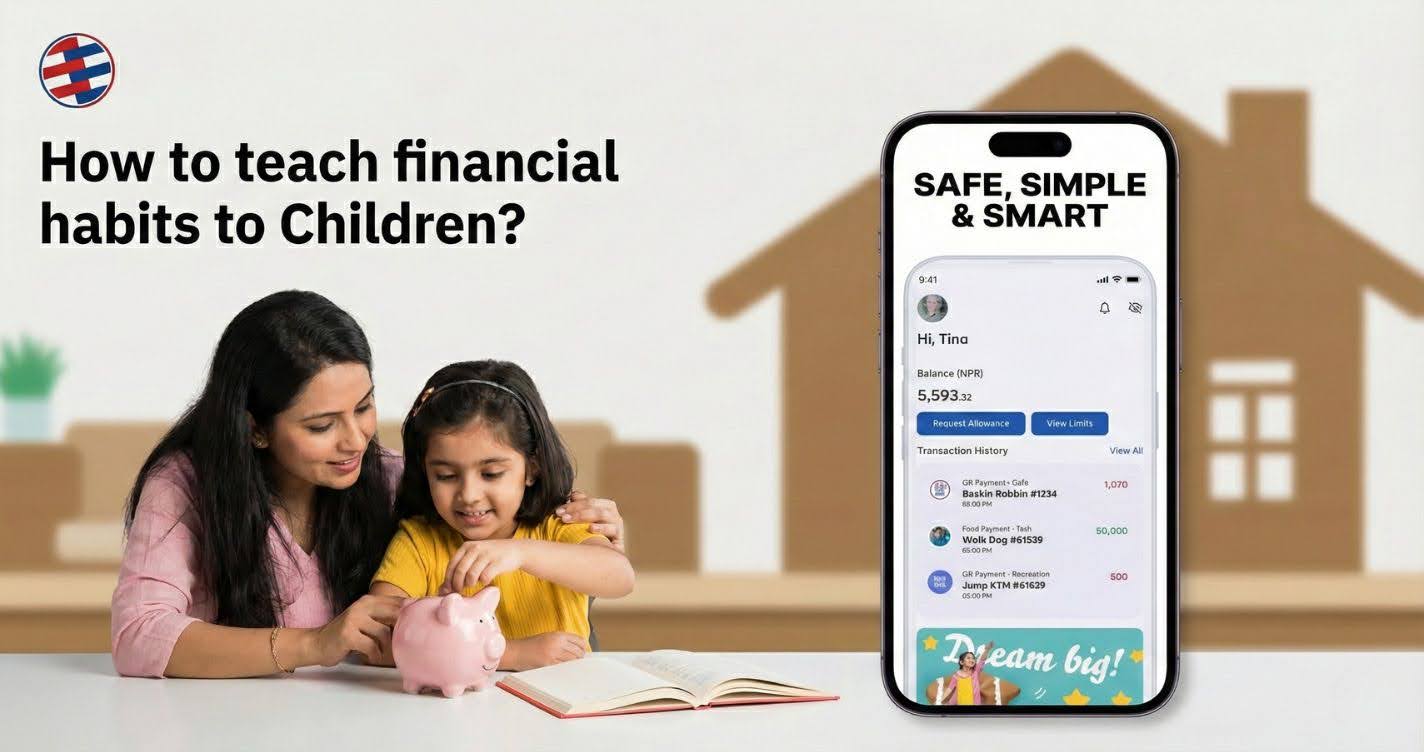

Are you looking for an app that helps to teach financial literacy to kids? Global IME Bank has introduced the Global Junior App, which is especially designed for young children to promote financial literacy and adopt digital banking from an early age.

The app is made for children and teenagers aged 10 to 17. It helps them learn how to save money, spend wisely, and manage money safely, with parents monitoring their activity.

How the App Helps Children Build Financial Discipline

The app gives children their own space to manage pocket money, track spending, and set savings goals under parental supervision. They can deposit, track, and spend under guided limits. Children can set their own saving goals and earn interest on their savings, which helps them understand the concepts of saving. Also, children can earn money by completing the task assigned by parents.

Download the app to get started.

Final Thoughts

Good financial education can start from home. Parents do not need complex lessons. Simple daily actions, conversations, and examples are enough to build strong money habits over time.

Frequently Asked Questions

At what age should financial education start?

There is no ideal age to start. Start early from the basics. Preferable after the child reaches 10.

How can parents make financial lessons fun?

Parents can make financial lessons fun by making financial concepts into interactive activities such as using game challenges or real-life examples like saving in a piggy bank or budgeting for a family tour.

Should children have bank accounts?

Yes, having a bank account encourages them to adopt banking services from an early age.

Are digital banking apps safe for kids in Nepal?

Yes, Global Junior Apps is designed for children under their parents’ control, which makes it safe and secure for kids.