Acceptance letter from a prestigious university is a significant step towards further studies. The next critical step is to organize the necessary finances. For the majority of Nepalese students, an education loan is the ideal solution to fund their academic journey, either domestically or internationally.

The loan application process, however, requires proper preparation, particularly documentation. This paper provides a comprehensive and methodical checklist of all the documents necessary for major financial institutions in Nepal for an education loan. Following it will ensure your process runs smoothly and heighten your possibilities of being approved.

The Reason for Complete Documentation

While the documents seem to be extensive, each document serves a specific and crucial purpose for the lender. The bank utilizes your file submitted to:

- Verify Identity and Eligibility: To determine that guarantors and the applicant meet the bank’s minimal requirements.

- Assess Academic Merit: To determine that the applicant is pursuing an acceptable course of study and institution.

- Assess Repayment Ability: To analyze the financial status of the guarantor and determine whether or not they are able to repay the loan.

- Secure the Loan against Collateral: To legally record and verify the property provided as collateral for the loan, practice in Nepal.

- A well-documented and well-prepared set of documents signifies credibility and accelerates the loan disbursement process by a huge extent.

The Essential Document Checklist for Education Loans

The following is a step-by-step breakdown of documents typically required by banks across Nepal.

1. Documents of Personal Identification

They establish the identification and relationship of all individuals involved in the loan application.

Photographs: Recent passport-sized photographs of the applicant, co-applicant (if any), and all guarantors.

Citizenship Certificate: Clear photocopy of the applicant’s and all guarantors’ citizenship certificate. You will also need to mention National ID number to open bank account.

Relationship Certificate: A certified copy of the local ward office stating the relationship between the guarantor(s) and the applicant. In the case of a spouse being an applicant or guarantor, a marriage certificate needs to be furnished as well.

PAN Certificate: Photocopy of the Permanent Account Number (PAN) certificate of the principal income-earning guarantor.

Location Map: A map indicating the route to the applicant’s residence.

Passport and Visa: In case of study abroad, a valid passport and the right student visa are needed.

2. Academic Documents

This part confirms the applicant’s educational background and admission to a course.

- Academic Certificates and Transcripts: Original and photocopies of academic certificates from the SLC/SEE level and above, i.e., +2/Intermediate/Bachelor/Master – as required.

- Offer Letter / Admission Confirmation: Formal acceptance letter from the institution. This letter will specify the course, duration, and total fee structure.

- English Proficiency Test Scores: Original score reports of test such as IELTS, TOEFL, or PTE, if mandatory for joining the program or by the host nation.

3. Financial Documents: Demonstrating Repayment Ability

This is a critical section of the application. The specific documents required will vary based on the guarantor’s income source.

For Salaried Persons:

- Recent salary certificate issued by the employer (within three months).

- Recent bank statements of the last six to twelve months showing regular salary credits.

- Evidence of payment of tax (TDS certificates).

For Pension Income:

- The original Pension Certificate (‘Patta’).

- Recent bank statements of the last six months showing regular pension credits.

For Remittance / Foreign Income:

- Remitter’s employment contract, valid visa, and passport.

- A certificate of salary issued by the foreign employer.

- Bank statements indicating a history of regular remittance remittances.

For Business or Self-Employment Income:

Firm/Company registration certificates and requisite legal documents, which are.

- Audited financial statements of the last two fiscal years.

- A recent tax clearance certificate.

- Company bank statements of the last six to twelve months.

For Rental Income:

A valid rental or lease agreement.

- The title deed (‘Lal Purja’) of the rented property.

- Receipts of the latest rental tax payment.

4. Collateral-Related Documents (Property)

As most education loans in Nepal are secured by property, the following documents related to property are required.

- Original Title Deed (‘Lal Purja’): The original land ownership certificate.

- Deeds of Transfer: All supporting deeds, such as ‘Rajinama’ or ‘Bakaspatra’, that trace the ownership chain.

- Boundary Certificate (‘Char Killa’): Official certificate by the local council marking the four boundaries of the property.

- Land Revenue Receipt (‘Tiro Rasid’): Recent receipt for payment of land revenue tax.

- Blue Print and Trace Map: Official survey plans of the land plot.

- Building Permits and Completion Certificate (‘Naksa Pass’, ‘Sampanna’): If a building stands on the property, its approved architectural plans and completion certificate by the municipality are needed.

Important Tips to Facilitate a Hassle-Free Loan Application Process

Begin Preparation in Advance: Preparation of these documents, especially the collateral-based ones, consumes time. It is advisable to begin well ahead of your application filing date.

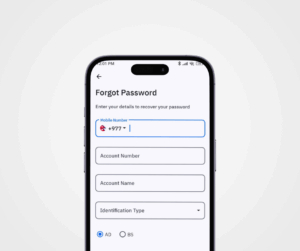

Consult with a Bank Representative: Before compiling your final file, schedule a meeting with a banking professional at the bank. They can provide the most current requirements and clarify any institution-specific policies.

Request for the Moratorium Period: There is a moratorium period, a feature of most education loans. Request your bank to set terms for this period, e.g., duration and payment schedule.

Know the Timeline: Once all complete documents are received, the verification process of the bank, legal check, and property valuation process will typically take 7-15 working days.

Thorough preparation and a well-organized application folder are essential to becoming successful in securing the financial aid needed to attain your educational goals.