If you need to send or receive money internationally, you will require a SWIFT code. In this article, we will discuss what a SWIFT code is, why you need it, and how you can use Global IME Bank’s SWIFT code for international transactions.

What is a SWIFT Code?

A SWIFT code is a special code which is utilized to specify banks all over the world. It makes sure that you transfer money in a foreign country to the right bank. Each bank possesses its own SWIFT code.

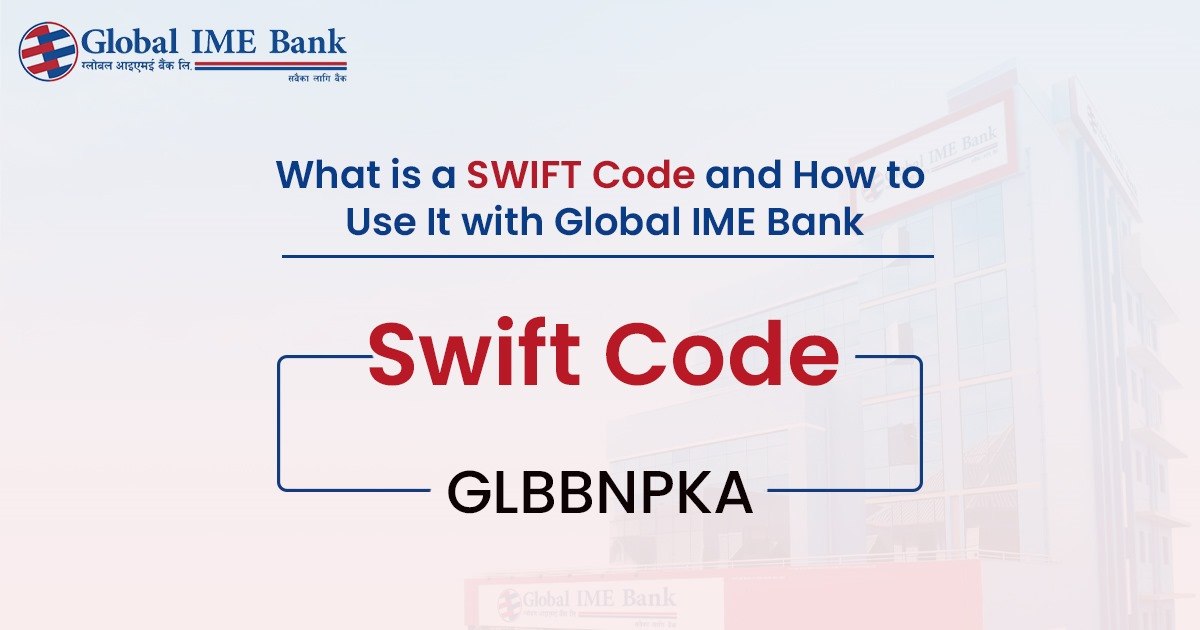

For Global IME Bank, Global IME Bank’s SWIFT code is GLBBNPKA . This SWIFT code makes sure your money goes to the correct branch of Global IME Bank while transferring money abroad.

Why do we Need to use the SWIFT Code?

The SWIFT code is necessary because:

- It transfers money to the right bank: When you are sending or receiving money internationally, the SWIFT code makes sure your money reaches the right bank.

- It secures payments: The SWIFT code is part of a secure network that protects your money from risk while it’s being moved.

- It makes transfer faster: With the SWIFT code, transfers between banks across countries are quicker.

How to Use the SWIFT Code?

Here’s how to use the SWIFT code:

- For international transfer: In case you are sending or receiving money from abroad, you will need the SWIFT code of Global IME Bank.

- For foreign currency transactions: In case you are dealing with foreign currency, the SWIFT code makes everything go through fine.

For remitting international services: We are referring, whether you are remitting goods or services of your foreign country, the SWIFT code helps your payment to end up in the right bank.

Where to Get SWIFT Code of Global IME Bank ?

The SWIFT code of Global IME Bank is IMEBNPKA and you can use it directly for all your international transfers. If you want to verify or confirm this information yourself character by character while using it, you can find the swift code of Global IME Bank by:

Visiting Global IME bank’s swift code site page. You can also use Swift Generator obtaining the SWIFT information.

Contacting customer care: You can mail or contact Global IME Bank to ask for the SWIFT related instruction.

What If I Use the Wrong SWIFT Code?

If an incorrect SWIFT code is entered, your money may go into the wrong bank, or get stuck. It’s always best to double-check the SWIFT code to make sure your money gets where it should.

Conclusion

The SWIFT code is an important code that ensures your money ends up in the right bank when you are making or receiving international transactions. If you are using the services of Global IME Bank, the SWIFT code of Global IME Bank is GLBBNPKA . Make sure you use the right SWIFT code for quick and safe international payments.

FAQs

What is the SWIFT code of Global IME Bank?

Global IME Bank’s SWIFT code is GLBBNPKA.

Why do I need a SWIFT code for international payments?

A SWIFT code helps ensure that your money ends up at the intended bank when making foreign money transfers.

What is the SWIFT code for Kathmandu?

There will be a distinct SWIFT code for every bank in Kathmandu. You may find the SWIFT code of a specific bank in Kathmandu on the bank’s website or customer care.

How do I find my bank’s SWIFT code?

You can check your SWIFT code on your bank’s website, through the customer service, or by checking your bank statements. At Global IME Bank, you can confirm the swift code of Global IME Bank through our dedicated swift code page.

Does all the bank have a SWIFT code?

Yes, every bank in the world has a unique SWIFT code that it uses to identify itself while making international payments.

What is the structure of the SWIFT code?

A SWIFT code may be 8 to 11 characters long with numbers and letters. It indicates the bank, country, and branch location.

Is the SWIFT code identical to the BIC code?

Yes, the SWIFT code is also known as the BIC (Bank Identifier Code). Both are used to find banks in cross-border transactions.

What if I obtain an incorrect SWIFT code?

Obtaining an incorrect SWIFT code can mean that your money is sent to the wrong bank or is delayed. It is important to double-check the correct SWIFT code.