You require financial support to set up or develop your business, and Global IME Bank offers easily obtainable loans to flourish your business. We have a loan solution for all, ranging from small businesses to big enterprises.

Different Kinds of Business Loans at Global IME Bank

Here are the various types of business loans as provided by Global IME Bank:

Global Byawasaya Tewa Karja

This loan is perfect for businesses looking for financial support to grow. You can borrow up to Rs. 20 million with a loan term of up to 10 years. The best part? We offer competitive interest rates to keep it light on your wallet. With Global Byawasaya Tewa Karja , business owners can also have turnaround time-3 days after submission of full documents.

Global IME Small Business Loan

If your business has annual turnover of Rs. 30 lakh or less, you can apply for the Global IME Small Business Loan. You can borrow up to Rs. 15 lakh at competitive rates of interest, low fees, and valuable guidance to enable your company to grow.

Global Hire Purchase Loan

Looking to buy equipment or vehicles for your business? Our Global Hire Purchase Loan helps you procure the assets you need at low rates and comfortable repayment terms. For manufacturing or construction, we make it easy to get the tools you need.

Global IME Krishi Karja

For farmers and business entities involved in farming activities, the Global IME Krishi Karja provides loan from Rs. 5 lakh to Rs. 1 crore. We offer low interest rate, fewer documents, and faster processing, which will help farmers grow their businesses.

Infrastructure/Project & Consortium Loans

If you are involved in large projects, our Infrastructure/Project & Consortium Loans provide the financing you need. We can also arrange for you to receive loans from multiple banks if your project needs more finance.

Why Choose Global IME Bank for Business Loans?

Global IME Bank has the right financial products for all types of business. Our loans have fast approval, competitive pricing, and great support so you can focus on the growth of your business. No matter what your equipment, expansion, or operational need, we are here to help.

Get Started Today with a Business Loan

If you’re ready to grow your enterprise, visit any of our branches or contact our customer care to find out more about our business loans. We’re here to assist you in prospering.

FAQs on Getting Easy Business Loans in Nepal

How to take a business loan in Nepal?

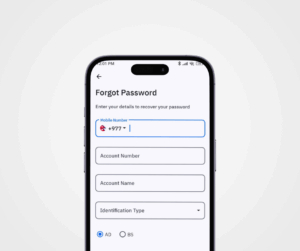

To take a business loan in Nepal, you can visit any branch of Global IME Bank and submit the necessary documents. Our representatives will guide you through the process, helping you choose the loan that suits your needs.

Which loan is best for business?

Global IME offers several loan options tailored for businesses, such as the Global Byawasaya Tewa Karja, Global IME SME Loan, and Global Hire Purchase Loan. The best loan for your business depends on your specific needs, like the amount, duration, and purpose of the loan.

What is the interest rate for a loan in Nepal?

The interest rate for loans in Nepal varies depending on the type of loan and repayment terms. For specific rates, visit Global IME Bank or check the loan details on our website.

Which bank gives a loan easily?

Global IME Bank is known for its fast approval process, especially for small and medium-sized enterprises. Our expert team is here to guide you through every step of the loan application process.

Who can apply for a business loan at Global IME Bank?

Any size of business can apply for a loan, from when you’re starting out to when you’re already running a large business. We provide loans for retail, manufacturing, agriculture, and many other businesses.

How soon can I expect approval for a business loan in Nepal?

Global IME Bank’s approval for a loan is quick and simple. After you have presented documents, we try to approve your loan immediately so that we can give you the cash you require.

Do you have any hidden fees for business loan?

No, we don’t have hidden fees. We strive to reveal all the fees and costs beforehand so that you would know what to anticipate.